-

Table of Contents

“Revolutionizing Finance: Fintech’s Bold Leap Beyond Traditional Banking”

Introduction

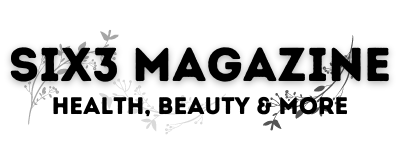

The financial technology (fintech) sector is revolutionizing the traditional banking landscape by leveraging advanced technologies to offer innovative financial services. Fintech companies are introducing new ways to manage money, make payments, and access credit, often with greater efficiency, lower costs, and enhanced user experiences compared to conventional banks. This disruption is driven by the integration of artificial intelligence, blockchain, big data, and mobile applications, which enable personalized financial solutions and real-time transactions. As a result, fintech is not only challenging the dominance of established financial institutions but also democratizing access to financial services, fostering financial inclusion, and reshaping the future of banking.

The Rise Of Digital-Only Banks

The financial technology (fintech) sector has been making significant strides in recent years, fundamentally altering the landscape of traditional banking. One of the most notable developments in this arena is the rise of digital-only banks. These institutions, which operate exclusively online without any physical branches, are challenging the conventional banking model and reshaping the way consumers interact with financial services.

Digital-only banks, also known as neobanks, have emerged as formidable competitors to traditional banks by leveraging advanced technology to offer a seamless, user-friendly experience. Unlike their brick-and-mortar counterparts, digital-only banks provide services through mobile apps and websites, allowing customers to manage their finances from the comfort of their homes or on the go. This convenience is particularly appealing to tech-savvy millennials and Gen Z consumers, who are accustomed to conducting most of their activities online.

Moreover, digital-only banks often boast lower operating costs compared to traditional banks. Without the need for physical branches and the associated overhead expenses, these institutions can pass on the savings to their customers in the form of lower fees and higher interest rates on deposits. This cost-efficiency is a significant draw for consumers who are increasingly frustrated with the high fees and subpar interest rates offered by traditional banks.

In addition to cost savings, digital-only banks are also at the forefront of innovation in financial services. They utilize cutting-edge technologies such as artificial intelligence, machine learning, and blockchain to enhance their offerings and improve customer experience. For instance, many digital-only banks employ AI-driven chatbots to provide instant customer support, while others use machine learning algorithms to offer personalized financial advice and insights. Blockchain technology, on the other hand, is being explored for its potential to enhance security and transparency in transactions.

Furthermore, the rise of digital-only banks has been facilitated by the increasing regulatory support for fintech innovations. Governments and regulatory bodies around the world are recognizing the potential benefits of fintech and are creating frameworks to encourage its growth. For example, the European Union’s Revised Payment Services Directive (PSD2) has opened up the banking sector to greater competition by allowing third-party providers to access bank customers’ data with their consent. This regulatory shift has paved the way for digital-only banks to offer more competitive and innovative services.

However, the rapid growth of digital-only banks is not without its challenges. One of the primary concerns is cybersecurity. As these banks operate entirely online, they are prime targets for cyberattacks. Ensuring robust security measures to protect customer data and funds is paramount for maintaining trust and credibility. Additionally, digital-only banks must navigate the complexities of regulatory compliance in different jurisdictions, which can be a daunting task given the varying requirements and standards.

Despite these challenges, the momentum behind digital-only banks shows no signs of slowing down. Their ability to offer convenient, cost-effective, and innovative financial services is resonating with a growing number of consumers. As traditional banks grapple with the need to modernize and adapt to this new reality, the rise of digital-only banks serves as a testament to the transformative power of fintech. The banking industry is undergoing a significant shift, and digital-only banks are at the vanguard of this revolution, heralding a new era of financial services that prioritize customer experience and technological innovation.

Blockchain Technology And Its Impact On Banking

Blockchain technology, a decentralized digital ledger system, is increasingly becoming a cornerstone of the financial technology (fintech) revolution, fundamentally altering the landscape of traditional banking. This innovative technology, which underpins cryptocurrencies like Bitcoin, is now being leveraged to enhance security, transparency, and efficiency in financial transactions. As a result, it is poised to disrupt conventional banking systems in profound ways.

One of the most significant impacts of blockchain technology on banking is its potential to streamline and secure transactions. Traditional banking systems often rely on a centralized database, which can be vulnerable to hacking and fraud. In contrast, blockchain’s decentralized nature means that data is distributed across multiple nodes, making it inherently more secure. Each transaction is recorded in a block and linked to the previous one, creating a chain that is virtually tamper-proof. This enhanced security is particularly appealing in an era where cyber threats are increasingly sophisticated and prevalent.

Moreover, blockchain technology can significantly reduce transaction times and costs. Traditional cross-border payments can take several days to process and involve multiple intermediaries, each adding their own fees. Blockchain can facilitate near-instantaneous transactions by eliminating the need for these intermediaries. For instance, Ripple, a blockchain-based payment protocol, allows for real-time, cross-border payments with minimal fees. This efficiency not only benefits consumers but also opens up new opportunities for businesses to operate on a global scale without the traditional financial barriers.

In addition to improving transaction efficiency, blockchain technology also enhances transparency and accountability in banking. Every transaction recorded on a blockchain is visible to all participants in the network, creating an immutable audit trail. This transparency can help reduce fraud and ensure compliance with regulatory requirements. For example, banks can use blockchain to track the provenance of funds, making it easier to detect and prevent money laundering activities. This level of transparency is a stark contrast to the opaque nature of traditional banking systems, where information is often siloed and difficult to access.

Furthermore, blockchain technology is fostering innovation in the realm of smart contracts. These self-executing contracts with the terms of the agreement directly written into code can automate and enforce contractual obligations without the need for intermediaries. In the banking sector, smart contracts can be used for a variety of applications, such as automating loan disbursements and repayments, thereby reducing administrative overhead and the potential for human error. This automation not only increases efficiency but also enhances trust between parties, as the contract’s execution is guaranteed by the underlying blockchain technology.

Despite these advantages, the integration of blockchain technology into traditional banking is not without challenges. Regulatory uncertainty remains a significant hurdle, as governments and financial regulators grapple with how to oversee and manage this emerging technology. Additionally, the scalability of blockchain networks is a concern, as the current infrastructure may not be able to handle the volume of transactions processed by traditional banking systems. However, ongoing research and development efforts are aimed at addressing these issues, and many industry experts believe that it is only a matter of time before these challenges are overcome.

In conclusion, blockchain technology is set to revolutionize the banking industry by enhancing security, reducing transaction times and costs, increasing transparency, and fostering innovation through smart contracts. While challenges remain, the potential benefits of blockchain are too significant to ignore. As fintech continues to evolve, traditional banks will need to adapt and embrace this disruptive technology to stay competitive in an increasingly digital world.

The Role Of Artificial Intelligence In Financial Services

Artificial intelligence (AI) is revolutionizing the financial services industry, fundamentally altering how traditional banking operates. This technological advancement is not merely an incremental improvement but a seismic shift that is reshaping the landscape of financial services. The integration of AI into fintech has introduced efficiencies, enhanced customer experiences, and provided robust security measures, thereby disrupting the conventional banking model.

One of the most significant impacts of AI in financial services is its ability to process vast amounts of data at unprecedented speeds. Traditional banks, often encumbered by legacy systems, struggle to manage and analyze the growing volumes of data generated by their operations. In contrast, AI algorithms can sift through this data, identifying patterns and trends that would be impossible for human analysts to detect. This capability allows financial institutions to make more informed decisions, optimize their operations, and offer personalized services to their customers.

Moreover, AI-driven chatbots and virtual assistants are transforming customer service in the banking sector. These tools provide instant, 24/7 support, handling a wide range of inquiries from balance checks to complex financial advice. By automating routine tasks, banks can free up human resources to focus on more strategic activities, thereby improving overall efficiency. Additionally, the use of natural language processing (NLP) enables these AI systems to understand and respond to customer queries in a more human-like manner, enhancing the customer experience.

In the realm of risk management, AI is proving to be a game-changer. Traditional risk assessment methods often rely on historical data and static models, which can be slow and inflexible. AI, on the other hand, employs dynamic algorithms that can adapt to new information in real-time. This adaptability is particularly valuable in detecting fraudulent activities. Machine learning models can analyze transaction patterns and flag anomalies with a high degree of accuracy, thereby reducing the incidence of fraud and enhancing the security of financial transactions.

Furthermore, AI is playing a crucial role in investment management. Robo-advisors, powered by sophisticated algorithms, are democratizing access to investment services. These platforms offer personalized investment advice based on an individual’s financial goals, risk tolerance, and market conditions. By leveraging AI, robo-advisors can provide high-quality investment recommendations at a fraction of the cost of traditional financial advisors, making investment services more accessible to a broader audience.

Despite these advancements, the integration of AI in financial services is not without challenges. Data privacy and security concerns are paramount, as financial institutions handle sensitive information. Ensuring that AI systems comply with regulatory requirements and ethical standards is critical to maintaining customer trust. Additionally, the reliance on AI raises questions about accountability and transparency. As these systems become more complex, understanding how they make decisions becomes increasingly difficult, posing a challenge for both regulators and financial institutions.

Nevertheless, the potential benefits of AI in financial services far outweigh the challenges. As technology continues to evolve, the role of AI in fintech is expected to expand, driving further innovation and disruption in the traditional banking sector. Financial institutions that embrace AI will be better positioned to navigate the complexities of the modern financial landscape, offering superior services to their customers and maintaining a competitive edge in an increasingly digital world.

How Peer-To-Peer Lending Platforms Are Changing The Loan Market

The financial technology, or fintech, revolution is reshaping the landscape of traditional banking, and one of the most significant areas of disruption is the loan market. Peer-to-peer (P2P) lending platforms are at the forefront of this transformation, offering an alternative to conventional bank loans that is both innovative and accessible. These platforms connect borrowers directly with individual lenders, bypassing the traditional banking system and its associated costs. As a result, P2P lending is democratizing access to credit and providing new opportunities for both borrowers and investors.

The rise of P2P lending can be attributed to several factors, including advancements in technology, changing consumer preferences, and the aftermath of the 2008 financial crisis. The crisis eroded trust in traditional financial institutions and led to tighter lending standards, making it more difficult for individuals and small businesses to secure loans. In response, fintech companies developed P2P lending platforms that leverage technology to streamline the lending process, reduce overhead costs, and offer competitive interest rates.

One of the key advantages of P2P lending platforms is their ability to provide loans to individuals who might otherwise be excluded from the traditional banking system. These platforms use sophisticated algorithms and data analytics to assess creditworthiness, often considering a broader range of factors than traditional banks. This approach allows P2P lenders to serve a more diverse pool of borrowers, including those with limited credit histories or unconventional income sources. Consequently, P2P lending is expanding financial inclusion and offering a lifeline to those who might struggle to obtain credit through traditional means.

Moreover, P2P lending platforms offer significant benefits to investors. By cutting out the middleman, these platforms enable individual lenders to earn higher returns on their investments compared to traditional savings accounts or bonds. Investors can choose from a variety of loan options, diversifying their portfolios and managing risk more effectively. Additionally, the transparency and accessibility of P2P lending platforms empower investors to make informed decisions based on detailed borrower profiles and loan performance data.

However, the rapid growth of P2P lending has not been without challenges. Regulatory scrutiny has increased as authorities seek to protect consumers and ensure the stability of the financial system. In some regions, P2P lending platforms are required to adhere to stringent regulations, which can impact their operations and growth potential. Furthermore, the risk of default remains a concern for both borrowers and lenders. While P2P platforms employ rigorous credit assessment processes, the absence of traditional collateral can make it difficult to recover funds in the event of a default.

Despite these challenges, the future of P2P lending appears promising. The continued evolution of technology, coupled with growing consumer demand for alternative financial services, suggests that P2P lending will play an increasingly important role in the loan market. As platforms refine their algorithms and expand their offerings, they are likely to attract a broader range of participants, further disrupting the traditional banking model.

In conclusion, peer-to-peer lending platforms are fundamentally changing the loan market by providing an alternative to traditional bank loans that is more inclusive, efficient, and transparent. By leveraging technology to connect borrowers and lenders directly, these platforms are democratizing access to credit and offering new opportunities for investment. While challenges remain, the ongoing growth and innovation in the P2P lending sector indicate that it will continue to be a significant force in the financial landscape, reshaping the way we think about borrowing and lending in the digital age.

Conclusion

Fintech is significantly disrupting traditional banking by leveraging advanced technologies such as artificial intelligence, blockchain, and big data to offer more efficient, personalized, and accessible financial services. This disruption is evident in the rise of digital-only banks, peer-to-peer lending platforms, and mobile payment solutions, which provide faster, cheaper, and more user-friendly alternatives to conventional banking services. As a result, traditional banks are being forced to innovate and adapt to maintain their competitive edge, leading to a more dynamic and customer-centric financial landscape.